Friday has arrived once more. Given the way the stock market has been behaving, I have one more reason to love Friday. It is the eve of two days where the idiots of Wall Street have to be content with no trades. So, no matter what Trump Tweets, or what Congress does not decide, or who Syria decides to murder, the market stays where it is for two blessed days.

When we decide to give up our day jobs things like market volatility take on a new perspective. While working, any drops in the market can be viewed as an “oh well,” situation. While retired, such declines are accompanied by a nitro-glycerin capsule under the tongue. Sage advice is to think in long-term concepts both for those still working and retired folks. That is good advice to follow as long as there is still some lifeline in the long-term.

Today’s JohnKu talks about stability. I hope you have a great weekend.

Stability by John W. Howell © 2018

Steady as she goes,

Is good for the heart and soul . . .

Chaos takes its toll.

Yes, John. Hugs Xx

LikeLiked by 1 person

Thanks, Jane. 😀 Hugs back.

LikeLiked by 1 person

WP lost your lovely comment on my ‘Boris’ post John. Very rude of them! More hugs for you all xXx

LikeLiked by 1 person

I see you found it.

LikeLike

🙂

LikeLiked by 1 person

I agree, John…let it ride!

LikeLiked by 1 person

*pushing all the chips on the betting spot. I’m with you. 😀 Thanks, Jill

LikeLiked by 1 person

No investments, no problem. My only concern is the exchange rate – our pensions are paid in UK in pounds sterling, and we live (and spend) in France, in euros.

And don’t get me started on Brexit!

LikeLiked by 1 person

Costly move. Glad you have not problems on investments.

LikeLiked by 1 person

love Friday… how do u feel about the 13th? lol

LikeLiked by 1 person

Notice I didn’t mention it. I tend to ignore superstitions. How about you, Ray?

LikeLiked by 1 person

My mum reminded me today…she’s usually scared of #friday13th 😂😂

LikeLiked by 1 person

Been too close to eternity too many times to be scared.

LikeLiked by 1 person

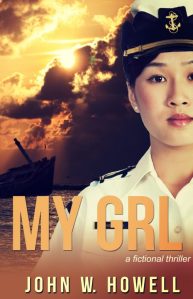

Good post, John. I love the lady at the top. Considering the little amount of interest my money seems to be earning I don’t think it’s invested in anything. Have a great weekend. 🙂 — Suzanne

LikeLiked by 1 person

Then you have nothing to worry about.

LikeLike

😀

LikeLiked by 1 person

:-D. Luckyyyy

LikeLike

I needed to hear/read this today. Sigh. Maybe we can act like we live in a 3-weekend world, and ignore the news/headlines/stock market on Fridays, also. ;-0

LikeLiked by 1 person

Good idea, Pamela. I’m avoiding all that today.

LikeLike

I’ve got stocks, but they were gifts as I grew up, so I have no idea how they work. Not to mention little interest in figuring it out. I do wonder why people thought it was a good idea to tie retirement funds into the market. One disaster and you lose everything, which makes it feel like gambling with your future.

LikeLiked by 1 person

I suppose for those of us who have some funds tied to the market it is a calculated risk. You are too young to understand the need for a combination of safety and growth to sustain life and prevent funds from running out. You will face this conundrum some day.

LikeLike

Most of my generation are looking at a future where retirement is a pipe dream. At least retiring with enough money to survive without getting a retail job.

LikeLiked by 1 person

Sad but true. Unfortunately there are only so many Wal-Mart greeter jobs available. 🙂

LikeLike

Excellent JohnKu, one of your best. Chaos does take a toll, no matter its form. Have a great day. 🙂

LikeLiked by 1 person

Thank you, Gwen. Seems like there is more of it these days. 😀

LikeLike

Excellent! Yes, being retired puts finances in a whole different perspective. It makes us vulnerable to “their” whims.

LikeLiked by 1 person

Sometimes I feel like I’m in a Google self- driving car headed for a cliff. Thanks, Jan

LikeLike

Love Friday, but hate the whims of the stock market. Even still working, my retirement is not that far away and is tied up in all that volatility. Ugh! Your JohnKu was perfect!

LikeLiked by 1 person

I would like to give the market and Congress a sleeping pill. I think both should take some time off. the less they do the better. (Having said that I don’t think Congress could do any less) Thanks, Mae.

LikeLiked by 1 person

The larger point of your JohnKu is exactly right. Chaos does take a toll, and there are forces abroad in the land dedicated to increasing the level of chaos — often for the sake of cyber-clicks. Shall I mention the media? The politicians? The shills for a variety of invented causes? No, I don’t believe I will. They drain too much energy.

LikeLiked by 1 person

I keep coming back to an Elvis song. “There will be peace in the valley someday. Oh yeah.”

LikeLiked by 1 person

Perfect JohnKu – sometimes you have to just take and deep breath and escape to your happy place for a while.

LikeLiked by 1 person

There is always wine too. Thanks, Teri.

LikeLike

Always.

LikeLiked by 1 person

😀

LikeLike

I wonder if retirement will even be an option for me. We’ll have things paid off prior, and I have a good retirement plan. As inflation plays its role, I may have to work until my expiration date. I saw up thread where you ignore superstitions. I write stories about them, but not Friday the 13th… yet.

LikeLiked by 1 person

Well you don’t see me writing about Friday the 13th either. A lot of folks will have to keep working. I think it might be the new normal.

LikeLiked by 1 person

Sadly, I agree.

LikeLiked by 1 person

Glad to read something is stable for two solid days 😀 wishing you a Peaceful weekend John

LikeLiked by 1 person

Thank you Sue. We have to make it that way.

LikeLiked by 1 person

🙂 So true. 🙂

LikeLiked by 1 person

🙂

LikeLike

Ultimately, Entropy wins, John. I don’t have a choice on retirement, it’s out-the-door at a specific point at our company. I can do other things, but I hope I get to choose the things I want to do.

LikeLiked by 1 person

Gee that’s harsh. I worked until I was 70 1/2. In the last five years I delivered over a Billion dollars (yes with a B) in operational savings. Think if they had thrown me out at 65? Minus $1B.

LikeLiked by 1 person

Those were some seriously productive years, unless they were paying you $200 Million a year 😉

LikeLiked by 1 person

Nope. Far below that. I was negotiating contracts to provision a new service.

LikeLiked by 1 person

Have a wonderful and peaceful weekend, John.

LikeLiked by 1 person

Thank you, John

LikeLike

Chaos seems to be the only constant right now and retirement not a guarantee anymore. This was an insightful johnku this week. Yes nice when we can take a break from the stockmarket and world in general… for the weekend makes Friday even better. Enjoy your weekend.

LikeLiked by 1 person

I’m starting a movement. Requires we ignore the world Friday through Sunday.

LikeLike

I’m in!

LikeLiked by 1 person

YAY

LikeLiked by 1 person

Meditatively brilliant!

LikeLiked by 1 person

Well, not sure about that, but thank you.

LikeLiked by 1 person

Thank YOU

LikeLiked by 1 person

:-D. Here take this Willett.

LikeLiked by 1 person

Far be it from me to refuse such fine hospitality . . .

LikeLiked by 1 person

RE John and Charles comments: remember the 100% Rule for investing: at age 75-80, likely NOT a good idea to be playing too much in the market (maybe 25% of our $accumulation – when we’re young we can take more risks because we have more time (presumably) to make up any losses…when older, it seems to me a better idea to preserve what we’ve accumulated – in my opinion, some of the fixed annuities offered by insurance companies/brokerss (Not necessarily ‘Variable Annuities’ tied to market yields) today offer some growth when markets go up BUT guarantee NO losses to your principle amount… DOWNSIDE? Annuities have surrender charges if you take your $ out before the term of the contract is up, but you are allowed to take a percentage out each year without penalty… UPSIDE? Regardless of surrender periods, all accumulation at death goes to beneficiaries/estate: principle plus growth! (NO Surrenders apply!)

Okay, Okay! More than you wanted to know, but could be beneficiall to some of your followers! ♥♥

LikeLiked by 1 person

Yes of course. Thank you, Billy Ray. (Charles fell asleep on your lesson.)

LikeLike

“Chaos takes its toll.” Indeed it does, John.

Wishing you a beautiful weekend. I’ll try and forgive you for not posting a “Twiggy fix” for my new addiction. 😉 Hugs

LikeLiked by 1 person

Twiggy only gets one appearance a week. She has work to do.

LikeLike

TGIF is right. My hubs and I are nearing retirement and the volatility is worrisome, but not unexpected either. Time to bury the gold in the backyard. 🙂 Have a great weekend, John.

LikeLiked by 1 person

I keep mine in the bathtub. Too many treasure hunters out there.

LikeLiked by 1 person

Ha ha. Nice. 😀

LikeLiked by 1 person

😀

LikeLiked by 1 person

Good advice for all in your JohnKu! We have been watching the stock market this week too as it affects our retirement funds. Have a good weekend – looks fair so far! Cheers!

LikeLiked by 1 person

Yup. Lots of wind. Sun too.

LikeLike

And chaos is reigning supreme right now, John…

LikeLiked by 1 person

I can feel it.

LikeLike

What a great post, John, all in all. Fridays are the best, too! Now enjoy your Saturday! The sun is shining here today, but more rain tomorrow and Monday. Sigh…

LikeLiked by 1 person

We have rain but badly needed, so no complaints.

LikeLiked by 1 person

Oh, perfect johnku! Yeah, we watch the market, my husband very closely. He is retired and likes to report to me how many money we gained or lost. I roll my eyes when we gain and suck in my breath when we lose. I’m still working, and we look at things long-term so … fingers crossed 😉 Have a great weekend, John. I’ve always considered Friday the 13th to be a lucky day but yesterday at work, well, my foot just edged a little further out the door 😉

LikeLiked by 1 person

Aw. I know what you mean. The last two years were the worst for me. Have a great Sunday.

LikeLiked by 1 person